News

Bravada Closes Oversubscribed Equity Financing, Provides Highland Project Update

June 12, 2020

Vancouver, British Columbia - (Newsfile Corp. - June 12, 2020) - Bravada Gold Corporation (TSXV: BVA) (FSE: BRTN) (OTCQB: BGAVF) (the "Company" or "Bravada") announces that it has closed the previously announced non-brokered private placement for total gross proceeds of $664,400 through the issuance of 8,305,000 units of the Company at a price of $0.08 per unit. The original $600,000 offering, previously announced on May 8th, 2020 has been oversubscribed. Each unit consists of one common share of the Company and one common share purchase warrant. Each warrant entitles the holder thereof to purchase a common share at an exercise price of $0.15 for a period of three years following the closing of the offering. Securities issued pursuant to the private placement, including common shares and share purchase warrants, carry a legend restricting trading of the securities until October 12, 2020. Finders' fees and commissions may be paid by the Company in relation to the units sold in this offering. The offering is subject to TSX Venture Exchange acceptance.

Net proceeds from the private placement will be used for certain accounts payable inclusive of sustaining fees for the Company's Nevada-based claims and for working capital.

Highland Project Update

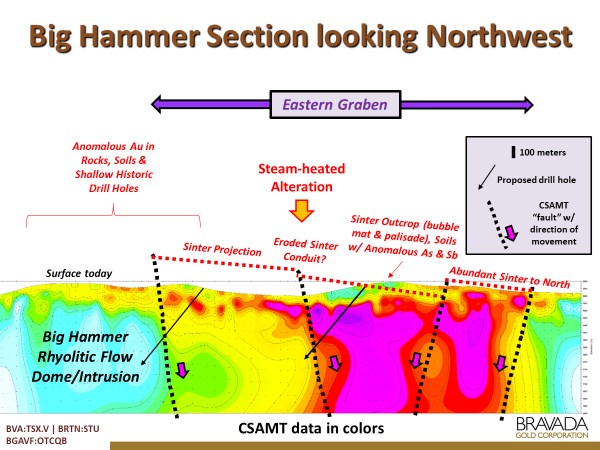

The Highland gold/silver project, located in Nevada's prolific Walker Lane gold trend, is an example of Bravada's modified Project Generator approach. The Company's 2020 exploration program is underway and is being funded by Option/Joint- Venture partner OceanaGold US Holdings Inc. ("OceanaGold"), a wholly owned subsidiary of OceanaGold Corp. Bravada has completed additional field work that firmed up drill specs and has submitted a drilling permit for 12 sites on two of the targets: the Big Hammer Target and the Geyser Target, which are approximately 2.5km apart along the western margin of the Eastern Graben. One or two of the sites will be drilled at the Big Hammer Target in 2020, beginning late August or early September, and targeting is underway for planned 2021 drilling at the Geyser Target. OceanaGold may earn up to a 75% interest in the Project after expenditures of US$10 million after which Bravada will participate in joint-venture exploration and development on a 75/25% basis (for details, see News Release NR-09-18, December 20, 2018).

President Joe Kizis commented, "Exploration in Nevada has come a long way from the days of heading out with a burro and a gold pan. Advances in geochemistry, geophysics, and 3D modeling combined with a fuller understanding of geologic processes that create "ore" provide modern explorers with tools to find deposits that do not stick out of the ground. Mapping sinter (the silica-rich rock formed by hot springs) is a relatively newtool that can be combined with other tools to discover the high-grade Au/Ag deposits that often develop well belowthe paleo-surface where sinter is deposited. The Eastern Graben area of the Highland project is uniquely suited for this type of study due to extensive preservation of sinter over several square kilometers. Sinter mapping can identify conduits (fossil geysers), which indicate channel ways for the hot fluids that may have deposited gold and silver where they boiled along the channel ways beneath the barren sinter." Click the link below for an informative video describing some of these features that are found at the Highland Project

Highland Project Update, June 4th, 2020

Figure 1: Big Hammer Section Looking Northwest

Figure 1: Big Hammer Section Looking Northwest

About Bravada

Bravada is an exploration company with a portfolio of high-quality properties in Nevada, one of the best mining jurisdictions in the world. Bravada has successfully identified and advanced properties with the potential to host high-margin deposits while successfully attracting partners to fund later stages of project development. Three of Bravada's ten Nevada properties are being funded by partners. Bravada's value is underpinned by a substantial gold and silver resource with a positive PEA at Wind Mountain, and the Company has significant upside potential from possible new discoveries at its exploration properties.

Since 2005, the Company signed 32 earn-in joint-venture agreements for its properties with 19 publicly traded companies, as well as a similar number of property-acquisition agreements with private individuals. Bravada currently has 10 projects in its portfolio, consisting of 764 claims for approximately 6,100 ha in two of Nevada's most prolific gold trends. Most of the projects host encouraging drill intercepts of gold and already have drill targets developed. Several videos are available on the Company's website that describe Bravada's major properties, answering commonly asked investor questions. Simply click on this link https://www.bravadagold.com/en/management-videos.php.

Joseph Anthony Kizis, Jr. (AIPG CPG-11513, Wyoming PG-2576) is the qualified person responsible for reviewing and preparing the technical data presented in this release and has approved its disclosure.

-30-

On behalf of the Board of Directors of Bravada Gold Corporation

"Joseph A. Kizis, Jr."

Joseph A. Kizis, Jr., Director, President, Bravada Gold Corporation

For further information, please visit Bravada Gold Corporation's website at bravadagold.com or contact the Company at 604.684.9384 or 775.746.3780.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. These statements are based on a number of assumptions, including, but not limited to, assumptions regarding general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the company's projects, and the availability of financing for the company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Bravada Gold Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of newinformation, future events or otherwise, except to the extent required by applicable law.