(Updated December 6th, 2021)

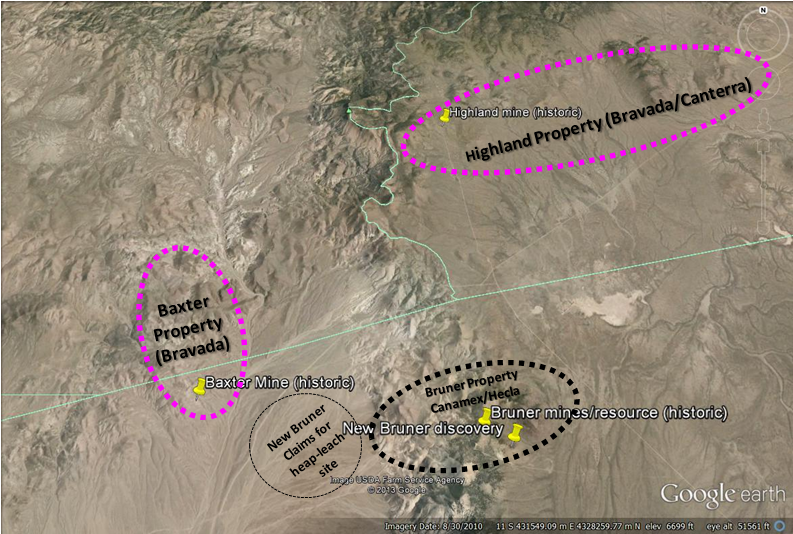

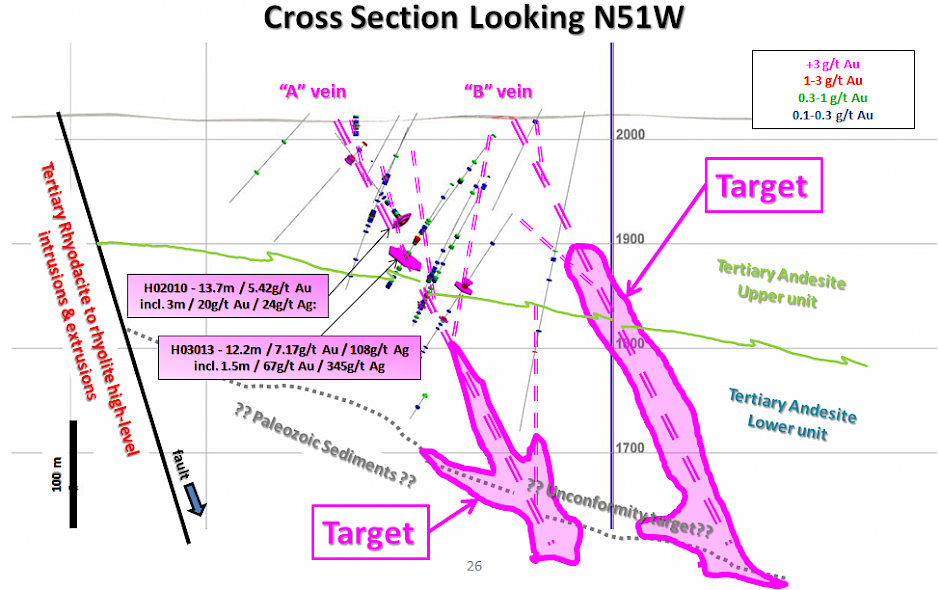

The Highland low-sulfidation-type project consists of 197 Federal lode claims for a total of approximately 1,500 hectares.The property is located in the Walker Lane Gold trend, north of the historic Bruner gold mine. Previous drilling by Bravada’s US subsidiary intersected vein zones with locally high-grade intercepts; the Company’s best hole, H02013, intersected 1.5 meters (m) of 66.9 grams of gold per ton (g/t) and 397.7g/t silver within a 12.2m intercept of 9.5g/t gold and 109.4g/t silver, with true thicknesses estimated at 65% of the intervals. A thin layer of alluvial gravel covers much of the property and various geophysical methods have been employed to identify other targets, which to date have not been tested with drilling. Detailed ground magnetics, four lines of IP, and one line of AMT have been conducted at Highland.

In July 2021, the Company and Headwater Gold Inc (“Headwater”) executed a Definitive Agreement (“Agreement”) whereby Headwater may earn up to 100 percent interest in The Highland Project. The property was returned in October 2021 after Headwater conducted limited mapping, sampling, gravity geophysics and seven R.C. drill holes. Bravada management has reviewed the data with Headwater and awaits final receipt of all factual data. The Company believes many attractive drill targets remain to be tested by drilling and plans to advance the project, possibly with a new partner.

History

No information is known about the early history of the Highland mine, also known previously as Magmatic Quartz mine. Gold is believed to have been discovered at Highland early in the 1900's, after gold was discovered to the north at Gold Basin and Eastgate. Highland was developed in the 1930's by a shallow incline shaft and a 50m-deep vertical shaft according to handwritten records and old reports. The project was reported to have produced for about 10 years from the early 1930's into the early 1940's, with production believed to have been not more than 10,000 ounces of gold. Reports indicate that minor production occurred at Highland in 1935 and again in 1955-56. The workings are currently inaccessible.

Only two settlement receipts could be found for the property, which indicate that at least 6 lots were shipped to the ASARCO Smelter in Salt Lake City during 1937. One shipment of 12 tons (Lot #1) assayed 1.4 opt Au and 6.5 opt Ag and one shipment of 6 tons (Lot #6) assayed 0.64 opt Au and 5.45 opt Ag.

Exploration of the Main Highland target prior to the 1990's was limited to trenching and drilling 13 shallow holes, which only explored the veins to a maximum depth of about 60m. The best intercept reported from this drilling assayed 3.6g/t Au over 5.8m, including 1.2m of lost core that was given a value of nil for this calculation. Checkmate Resources Ltd. and Miramar Gold Corporation did trenching during this period; some of the trenches remain open.

The current owners originally staked claims at Highland in 1996 and 1997. Fairmile Gold Mining Company leased the property from them between 1997 and 2001. Fairmile conducted mapping, sampling, and acquisition/compilation of previous data.

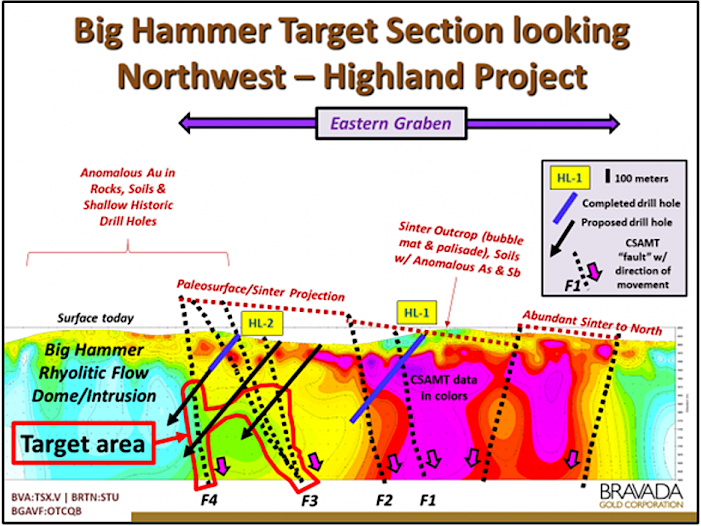

Fairmile extended the land package to cover the Big Hammer target, where low-to-moderate concentrations of gold were detected in surface samples. Cordex Exploration Company drilled 21 holes at this target during 1984 and 1985, and Fairmile obtained copies of their data. Cordex's drilling indicates little potential for an economic disseminated gold deposit within 150m of the surface; however, untested potential for high-grade gold and silver feeder veins at depth deserves further evaluation.

Minnova also held claims peripheral to the Main Highland area. Minnova flew an aeromagnetic geophysical survey over the western portion of the property, and drilled five reverse-circulation holes in outer regions of the Highland area. The aeromagnetics data shows interesting structural features, such as northwesterly trending lineaments reflecting the Highland vein system. Their drilling encountered only weakly anomalous concentrations of gold.

Hecla entered into an earn-in agreement with Fairmile from 1999 to 2000, and conducted a program of detailed ground magnetic geophysics over the Main Highland target and trenching at the Deb and Main Highland targets. The Deb target was trenched to determine the source of anomalous gold in float samples, which was determined to be mineralized boulders weathering out of a debris flow of Tertiary age. Based on rare and inconclusive paleodirection indicators, the source of the debris flow, and its mineralized boulders, lies to the west of the trenches, under alluvial cover. Another Hecla trench indicates that, based on weakly anomalous concentrations of gold and high concentrations of pathfinder metals in chalcedony/quartz veins, the Highland vein system extends to the southeast, adjacent to the Highland dome. A drilling program was permitted in order to test two structurally open portions of the Highland vein system; however, Hecla's management cut their U.S. exploration budget prior to drilling and returned the property to Fairmile. Fairmile defaulted on the property in 2001 due to lack of payments to the underlying owners.

Bravada acquired the property in June of 2002 and conducted additional geologic mapping and rock-chip sampling. The Company also completed two RC drilling programs during 2002 and 2003 for a total of 3,772m in 18 drill holes. Since 2004, the project has been advance via earn-in joint venture agreements.

Geological Setting

The Desatoya Mountains are a northerly trending, east dipping, fault block primarily composed of Tertiary rhyolitic volcanic rocks related to a large, Miocene (~25 to 21Ma) caldera. The Highland project area lies just south of the southern margin of this caldera, where younger (19Ma or younger) felsic volcanic domes formed. It is these younger volcanic domes that are related to low-sulfidation, epithermal gold/silver mineralization at Highland and other prospects in the region. Highland is at the eastern edge of the northwest-trending Walker Lane, an extensive structural zone that hosts numerous precious metal occurrences, primarily of Tertiary age, including such multi-million ounce deposits as Comstock, Rawhide, Tonopah, Goldfield, and Paradise Peak.

Porphyritic andesite underlies most of the area of the Main Highland target. It is moderately to strongly propylitically altered, and is argillized and/or weakly silicified near veins and faults. It forms a large area of rusty-brown soil south of the Highland Mine where float of chalcedonic vein material hosts anomalous gold in the range of 100 to 1,000ppb Au.

Tuffaceous sedimentary units exposed at the surface on the Highland property appear to be the youngest Tertiary rocks. Crudely bedded volcanic conglomerate, which may include rounded pebbles of chert from Paleozoic basement highs, and tuffaceous breccias are exposed and are locally silicified. Finer grained, light-colored tuffaceous sediments are also exposed. These rocks are weakly altered to clay with zones stained with iron oxides, and are variably silicified near sinter. Sinter appears to be interbedded with the younger sedimentary unit, but relationships are unclear due to very poor exposure. Some of the sediments are fluvial, with material derived from the uplifted caldera located to the north, and some are lacustrine.

Quaternary alluvium covers much of the property; however, trenching demonstrates that this cover is often only a meter thick. Alluvial gravel may be much thicker in the southeastern portion of the prospect due to Basin and Range faulting in Smith Creek Valley, however.

Northwest, west, and northeast -trending faults are recognized on the property. Northwest-trending structures vary from about N20W to N45W, generally dipping steeply to the east, and include the gold-bearing Highland vein system. The Highland vein system is a series of parallel and anatomizing veins that occur in a swath approximately 365m wide and that are exposed for about 1,800m along strike on the property. The veins have been offset by east-west faults, but open trenches reveal these east-west faults had both pre- and post-mineral movement. The veins and faults can be observed as prominent linears on detailed ground magnetics. Intersections of northwest and east-west faults could have been important channel ways for mineralizing fluids.

Bladed quartz-after-calcite replacement textures are abundant in veins at several of the altered areas on the property, and veins of bladed calcite occur at the outer edges of the Main Highland vein zone. Dogtooth and rhombic calcite occur as a late-stage filling of voids and as breccia matrix, indicating that carbonate-rich groundwater invaded the still-hot veins as hydrothermal activity waned.

Mineralization

Gold, silver, arsenic, antimony, mercury, and molybdenum are anomalous at the property. These metals often are indicators of productive low-sulfidation epithermal systems, forming halos around economic gold/silver deposits. Silver to gold ratios are also comparable to productive systems, generally less than 20:1 in better mineralized areas, as indicated by surface sampling, limited production records, and drilling.

Mineralization has been identified at several locations on the Highland Project. Three of the better known areas are:

The Main Highland target contains several gold/silver -bearing veins (<1 to +3m wide, true thickness) exposed within an area that measures approximately 1,800m by 365m. Minor high-grade production has been reported from erratic shoots within these veins.

The Northwest target hosts two sets of auriferous veins. One is the extension of the Main Highland target trend and the other trends northeasterly. Several surface grab samples of vein material from each set contain +1g/t Au. The widest portion of a northeast-trending vein is exposed in an open trench, where three samples of nearly continuous chip/channel material average 1.96g/t Au and 18.48g/t Ag over approximately 8m of true thickness.

The Deb target contains anomalous gold (up to 2.7g/t Au) in float samples of mineralized boulders that weathered out of a Tertiary debris flow. The source of the debris flow, and its mineralized boulders, is believed to lie to the west of the trenches, under alluvial cover.

Numerous gold occurrences exist elsewhere in the region, with the Bruner District, located 8km to the south, being the closest significant historic producer.

Drilling

When the Company’s program started in 2002, only 13 drill holes (five core holes, with one lost prior to targeted depth and then offset, and eight reverse-circulation rotary holes) existed at the Main Highland Target. Checkmate Resources LTD of Vancouver, British Columbia drilled 11 of these holes and Frank Lewis, a previous property owner, drilled two of them (one 65' deep and the other 205' deep). Checkmate drilled 306m of core (HQ size, with +95% recovery except in faulted zones) and 610m of rotary drilling. Hunter Mining Laboratory of Sparks, Nevada did fire assaying for Checkmate's drilling. Although strongly anomalous concentrations of gold were encountered, none of the holes intersected the vein deeper than 53m below the surface.

An unknown amount of drilling was conducted at the Northwest target. There is no data available for this drilling, but all holes appear to test only the near-surface portion of the veins and stockwork zones.

Cordex Exploration Company drilled 21 holes (3,108m) during 1984 and 1985 on and around the Big Hammer Target, a project they called Smith Creek. The first five holes appear to be direct-circulation rotary holes, with subsequent holes being reverse-circulation rotary. The first 16 holes were assayed using a 10-gram digestion and an atomic absorption assay at an unknown lab, with the remainder being fire assayed at their Dee Mine lab. These assays are of suspect quality due to the small amount of digestion (a 30-gram digestion is considered standard) and the use of atomic absorption instead of fire assay. Anomalous gold was reported in the drill holes in the 0.0X to 0.6g/t range. Although these holes may have negatively tested the target for economic, near-surface mineralization, they did not test for deeper, vein-related high-grade mineralization. Big Hammer appears to be less deeply eroded than the Main Highland target; thus, high-grade mineralization is expected to be deeper at Big Hammer.

Minnova drilled five reverse-circulation holes during 1991. Only weakly anomalous gold was intersected in this drilling; however, none of the holes tested areas of current interest.

The Company completed two RC-drilling programs at the Highland project during November and December of 2002 and 2003 for a total of 3,772m in 18 holes. Most holes tested a limited strike length of the Main Highland vein target corridor, and two holes tested a small portion of the Northwest target. Encouraging results of these programs includes 3m of 20.3g/t gold in hole H02010 and 1.5m of 66.9g/t gold in hole H03013.

MH drilled seven angled core holes totaling 2,190m during the winter of 2004 to 2005 to test targets developed through their detailed compilation work. The best intercept was on the A-vein of 0.3m of 9.46g/t Au and 414g/t Ag immediately down dip of the RC intercept drilled by the Company.

Newcrest Resources, Inc. drilled a total of 14 RC holes in 2006 for a total of 2,888m. Newcrest expanded the drilling to intersect the projection of the ‘A’ and ‘B’ Veins in the unexplored areas southeast of the high-grade gold mineralization in the ‘A’ Vein and targeted the projection of the ‘A’ and ‘B’ Veins northwest of the known gold mineralization, under alluvial cover. They also drilled four deep core holes totaling 1652m between October 2006 and January 2007. All four core holes were drilled in the vicinity of Highland Mine to test the down dip portion of the ‘A’ Vein beneath intercepts with the highest gold grades.

Newly Identified Targets

OceanaGold acquired an earn-in option agreement for the Highland Property late in 2018, concentrating work on the eastern portion of the property where less work had been conducted. The company funded exploration until late in 2020, when corporate priorities forced the strategic decision to exit the option agreement in order to focus on organic growth at its existing mine properties.

The 2020 program funded by OceanaGold consisted of limited field mapping, surface sampling for geochemical and clay-species data, and drilling two core holes at the Big Hammer Target. The drill holes were designed to explore for high-grade vein zones along several faults interpreted on a series of CSAMT geophysics lines collected during OceanaGold’s 2019 exploration program at Highland.

Hole HL-2 intersected a series of faults with widespread low-temperature silica alteration in the upper portion of the hole along with pervasive anomalous gold (<0.1g/t Au) and arsenic (100-300ppm As) geochemistry; however, the hole was terminated due to higher-than-expected drilling costs prior to reaching the targeted fault. Widespread samples of float, outcrop, and soils collected at surface of the fault contain anomalous gold and pathfinder geochemistry, with values in generally in the range of 0.1g/t to 1.0/g/t Au but with a maximum assay of 15g/t Au.